Introduction

The Stockholm International Peace Research Institute (SIPRI) reports that defence companies registered in the largest countries like the US, Russian Federation, People’s Republic of China, France and Germany are leading arms producers (SIPRI, 2020a). Nonetheless, companies in smaller countries managed to reach the SIPRI Top 100 list and in 2018 (SIPRI, 2021) were positioned accordingly: Elbit Systems (Israel) – 28; Saab (Sweden) – 30; Israel Aerospace Industries (Israel) – 39; Rafael (Israel) – 44; ST Engineering (Singapore) – 61; RUAG (Switzerland) – 95. A study of Emerging Suppliers in the Global Arms

Trade (SIPRI, 2020b) categorises Denmark and Singapore as the fastest-growing arms suppliers. If we consider the geographical size of those small countries, Singapore’s case stands out as it is only 726 m2.

The findings will allow us to explore the most recent successes and failures of Singapore’s DI, discuss DI strategy, and indicate a way forward for other small countries aiming for indigenous DI. This study is novel as it focuses on the 2000–2020 period, which is less frequently analysed and specifies defence articles manufactured in-country.

The study is divided into two parts. Firstly, it considers the factors influencing indigenous DI such as existing Singapore defence structures and Ministry of Defence (MINDEF) defence spending, research and development (R&D) activities, local arms procurement policies, arms imports, and exports. Secondly, Singapore’s DI is scrutinised with a focus on the largest indigenous DI company – ST Engineering.

Primary and secondary data were used and interpreted in the text. Primary data was collected through analysing official speeches and announcements of MINDEF, ST Engineering, SIPRI, and the Defence Science & Technology Agency (DSTA). Secondary data was collected from the most recent research articles. Throughout this study, quantitative and qualitative comparative analysis were used. Furthermore, the elements of the S-C-P model (Uzunidis, 2016) were used as a basis for defining Singapore’s DI and DI influencing factors. The aim of this study is to consider factors influencing Singapore’s defence industry (DI).

Factors influencing Singapore’s DI

Singapore defence spending

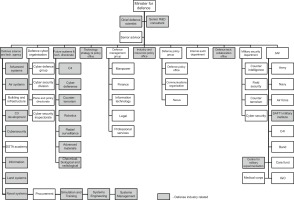

By 2021, Singapore’s defence spending (Figure 1) was 11.38 billion USD. However, the defence budget was revised in 2020 due to COVID-19 and cut from 11.17 billion to 10.09 billion USD.

Figure 1

SAF defence spending 2000–2021 (SIPRI, 2020c).

*APC – armored personnel carrier; AFV – armored fighting vehicle; IFV – infantry fighting vehicle; AC – aircraft; UAV – unmanned aerial vehicle; ASW – anti-submarine warfare; AEW&C – airborne early warning and control; MRL – multiple rocket launcher.

If we consider the last two decades, the sudden reduction in the defence budget was rare as the Singapore Armed Forces (SAF) have enjoyed stable and rising funding. However, in terms of GDP percentage, funding is slowly declining. Tendencies in the last two years indicate that Singapore is likely to increase its defence budget sharply due to recognition of the growing threat from the People’s Republic of China. The increase in defence spending could encourage an arms race in the Southeast Asian region. It is important to note that the impact of defence spending on economic growth in Singapore does not conform with the studies conducted by Benoit. It is quite the opposite, as Singapore’s DI ensures job creation, development of human capital, and technologies (Kuah and Loo, 2004).

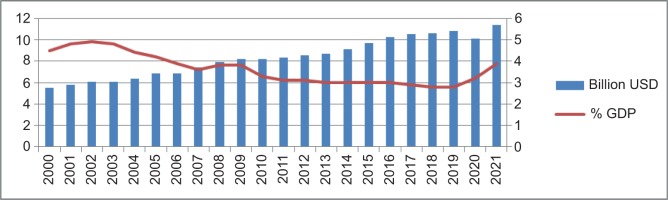

Singapore’s MINDEF, a structure facilitating technological innovation

It is stated that the Singapore MINDEF would accomplish its mission – to enhance peace and security – through strengthening its military, manpower, and the technological edge of the SAF and by fostering close relations with friendly countries in the region (MINDEF, 2021a). At the same time, MINDEF seeks to develop or purchase highly advanced technology that could serve as a substitute for a limited human resource (Manohara, 1998) and would act as “a critical force multiplier” (Bitzinger, 2021). This is due to Singapore’s “small-state survival ideology” that is compounded by a lack of strategic depth and a small and ageing population. Therefore, as elaborated on by Richard Bitzinger (2021), a technologically advanced military is seen as capable of offsetting its numerical and geographical disadvantages. As a result, Singapore’s MINDEF has a unique structure (Figure 2) that is adapted to the mission and, in particular, is focused on technological innovations.

Within the MINDEF structure, there are several organizations working on technological issues: DSTA; Future Systems and Technology Directorate (FSTD); Technology Strategy & Policy Office; Industry and Resources Policy Office; and the Defense Technology Collaboration Office. Other elements like the SAFTI Military Institute within SAF and the MINDEF Scholarship Centre could also be attributed to these innovations. Furthermore, there is a clear distinction between policy and execution branches within MINDEF, which makes an efficient approach. DSTA is the central procurement agency for the Singapore MINDEF and the SAF. At the same time, DSTA drives innovation and delivers state-of-the-art capabilities for SAF. DSTA runs multiple programs related to the developments in the single services within SAF and related to advanced systems. DSTA explores novel ways to develop and integrate acquired communication systems, sensor solutions, and guided weapons to enable faster detection and reaction. Furthermore, the agency collaborates with governmental agencies, R&D institutes, start-ups, and industry, experiments and rapidly prototypes new capabilities in various operations and training. DSTA explores emerging technologies in 5G, artificial intelligence, cloud computing, extended reality, the Internet of Things, data science, and robotics. One of the latest examples from DSTA is the Hunter Armoured Fighting Vehicle – a fully digitalised vehicle, developed in collaboration with SAF and ST Engineering. The Agency comprises nearly 5000 employees and is managed by a Chief Executive Officer (CEO). It is supervised by a board which is composed not only of MINDEF department heads and the Chief of Defence but also by other members: Chairman of Blackstone Singapore, Professor of the National University of Singapore; CEO Government Technology Agency; Chairman ST Engineering Ltd; Chief Digital Officer Economic Development Board; CEO Maritime and Port Authority (DSTA, 2021a). This structure implies a novel control concept used within MINDEF that potentially seeks greater efficiency within the agency. Furthermore, it indicates the cooperation level required to build an efficient and functioning system that supports indigenous DI. This is in line with Chinniah Manohara’s (1998) findings, who indicated that MINDEF has links with local academia, research institutions, and commercial enterprises inside and outside of the country, and these linkages enable MINDEF to know and better explore future state-of-the-art technologies.

FSTD is leading the development of emerging disruptive technologies and game-changing concepts that would increase SAF capabilities. The department focuses on cyber defence, C4, radar and surveillance technology, advanced materials, robotics, counter-terrorism, chemical, biological and radiological areas. The ideas for FSTD come from the SAF Centre for Military Experimentation which investigates new war-fighting concepts and assesses long-term SAF capabilities development. The most recent FSTD developments: air surveillance systems that can detect small drones in highly urbanized areas, integrated circuits chip for hardware Trojan detection, and driverless car SAFTI MI Shuttle (MINDEF, 2021c). There is a clear distinction between FSTD’s and DSTA’s activities and roles; and an innovative spirit has been cultivated since product development began.

The Technology Strategy & Policy Office works closely with SAF and indigenous DI and is responsible for formulating capability development strategies and developing defence technology policies and long-term plans (MINDEF, 2021d). The Industry and Resources Policy Office focuses on policy formulation and control in the spheres of industry development, technology security, procurement, defence capability management, infrastructure, logistics, and civil resources (MINDEF, 2021e). The Defence Technology Collaboration Office is responsible for developing and implementing policies and plans that allow facilitating engagements with local and international research institutions and organisations in the field of defence technology (MINDEF, 2021f).

The SAFTI Military Institute provides coherent and integrated professional development for SAF Officers serving in the Army, Navy, and Air Force. The Institute runs all levels of officer training from the junior level at Officer Cadet School to the senior command and staff level at the Singapore Command and Staff College. Besides training, the institute has four centres that study leadership, learning systems, military learning, and operational learning – all of which additionally contribute to the development of indigenous DI (SAFTI, 2021).

The SAF Centre for Military Experimentation was opened in 2003 to become a “one-stop centre for all SAF experiments.” The centre has three laboratories: Command Post, Battle and the C4I Lab. It is designed to help SAF to develop innovative operational concepts and doctrines that would allow enhancement of mission planning and acquirement of new war-fighting knowledge (DSTA, 2021b).

Singapore’s MINDEF has a long-term understanding of the need to have an educated workforce; therefore, there are options created for talented people to broaden their knowledge and practices. As a result, Singapore’s MINDEF and the SAF promote perspective scholars and offer various scholarships e.g. the SAF scholarship – covering 4 years of overseas studies and providing salary and other benefits. There are six types of scholarships to promote talented scholars and leaders. The process is managed by the MINDEF Scholarship Centre, specifically created for that purpose in 1999. The centre facilitates information exchange among scientific institutions and scholars, and hosts events like Tea Sessions and Career Talks that help to share information about opportunities (MSC, 2021).

To foster technological innovation, MINDEF annually issues a Defence Technology Prize to individuals and teams that have made significant technological contributions that enhance Singapore’s defence capabilities. To illustrate, in 2020, the prize was awarded for innovations and developments in biological defence, sonar and signal processing, and advanced electronics system fields (DSO, 2021).

It is clear that innovation in the Singapore DI sector is hierarchical and state-centric. Defence R&D efforts are holistically harmonised by MINDEF, carried out under DSTA supervision and coordinated with DSO Laboratories and the R&D offices in ST Engineering. In addition, there are several Singaporean government-sponsored high-tech incubators. Greater support is provided to government-supported R&D institutes, high-profile incubator projects, and joint initiatives (Bitzinger, 2021).

Most of the work of DSTA, DSO Laboratories, and ST Engineering revolves around adapting existing weapon systems to SAF requirements. Nevertheless, Singapore is criticised for possessing a “risk-averse” social and corporate culture and this, in turn, holds back innovation (Bitzinger, 2021).

To sum up, the Singapore MINDEF has five structural elements out of eleven departments/directorates/offices that are fully or partially engaged in defining SAF innovation policies, coordinating and reviewing implementation progress. Furthermore, the unique control structure of DSTA clearly indicates that the government, SAF, science, and private business are closely interlinked and that is more than an asset in a competitive global arms market. Singapore’s MINDEF has constantly updated its structures as this enables better innovations and advancements in the SAF. This has allowed Singapore DI to emerge in the field of emerging disruptive technologies as well and propose game-changing concepts like the driverless car SAFTI MI Shuttle, or a fully digitalised Armoured Fighting Vehicle Hunter.

Singapore Armed Forces

The SAF is made up of three services: Army, Navy, and Air Force. There are nearly 72.000 active duty personnel in service including conscripts. At the same time, the SAF are able to mobilise over 1.38 million trained reservists. The Army consists of six Combined Arms Divisions: 3 Div., 6 Div., and 9 Div., two Army Operational Reserve Divisions (21st and 25th), and one Island defence command (2nd People’s Defence Force). The Singapore Air Force has nearly 8.000 personnel and more than 300 planes. The force is structured into seventeen squadrons that are staged in seven domestic airbases and four located outside the country in Australia, the United States, Thailand, and France. The Navy is structured into eight squadrons and is located on two bases in Tuas and Changi (capable of accommodating aircraft carriers). It has 30 different classes of ships and four submarines and around 7.000 servicemen. The majority of SAF equipment is procured abroad, but some of it is manufactured locally in Singapore (Table 1). In parallel to acquiring new armaments, the SAF managed to achieve cost-efficiencies while extending the life cycle of existing armaments through upgrades (Manohara, 1998). Conscripts serve for two years; however, they can choose to serve not only in the SAF but also in the Singapore Police Force or Singapore Civil Defence Force. Interestingly, conscripts can shorten their service by two months if they manage to pass an Individual Physical Proficiency Test while achieving a certain minimal score (NS Portal, 2021).

Table 1

Military equipment used by SAF that is manufactured or being updated in Singapore (Air Force, 2021; Army, 2021; Navy, 2021).

As shown in Table 1, of the 84 types of defence articles used by the Singapore Army, 25 are manufactured in Singapore by ST Engineering and DSTA. Most of the systems are innovated by ST Engineering and DSTA and the remainder are manufactured under licences, or through collaborative arrangements. Nevertheless, certain defence items like the main battle tank, truck, pistol, shotgun, sniper rifle, mortar, and radar are imported.

Most of the ships used by the Singapore Navy are manufactured locally. Based on the data in Table 1, out of 26 articles, 10 are manufactured in Singapore. Nonetheless, the Singapore DI is not focused on manufacturing submarines, rigid-hull inflatable boats, aircraft, missiles, and torpedoes needed for the Navy.

There is basically no equipment manufactured locally that is currently used by the Singapore Air Force – all articles are imported. However, there were a few cases in the past when Singapore DI was involved in manufacturing items to be used by local Air Forces. The first case – the development of a short-range air defence system, the Mechanised Igla - this system was capable of engaging air threats in a more responsive and precise way with four Igla missile launchers and additional radar, day and night sights are situated on the M113A2 platform (MINDEF, 2021g). The second case – the Eurocopter EC120 Colibri helicopter, jointly developed and designed by ST Aerospace, Chinese and French companies, later only manufactured in France and Australia (Aerospace Technology, 2021). The third case – Singapore Aircraft Industries, updated the Douglas A-4SU Super Skyhawk attack aircraft in the 1980s.

Singapore, as noted by Keith Hartley (2010), participates with New Zealand, Australia, Malaysia and the UK in the military alliance of the Five Power Defence Arrangement. This gives a choice to Singapore, as a small country, to select low-level intensity force structures and equipment instead of costly high technology equipment, as the capabilities it needs can be delivered by bigger countries. This organisational structure allows balanced forces and specialisation.

Similar to other countries, the SAF are undergoing a military transformation to prepare for third-generation warfare, which is focused on the integration of technologies, in particular IT, for command and control, intelligence and surveillance systems, and precision-guided weapons. Current SAF priorities include stealth, precision weaponry, unmanned and command, control, communications, computing, intelligence, surveillance, targeting acquisition, surveillance systems, training, and protection technologies (Bitzinger, 2021).

The SAF are relatively small compared to neighbouring countries’ defence forces, but consideration should be given to the size of the country, number of trained reserves, the service time of conscripts and the regional defence agreement. Support provided by the indigenous DI in arming, updating, and maintaining the SAF is another factor that makes Singapore unique in the region. As the SAF prepare for third-generation warfare, the indigenous DI will play a major role in executing R&D and proposing developed systems that would provide maximum integration.

Procurement policy

There is agreement that defence spending is necessary to protect Singapore while building a strong and capable defence force. Building effective defence capabilities takes many years and requires a steady investment approach and long-term goals. Long-term and multi-year acquisition SAF programmes are discussed annually and approved by the Committee of Supply in Parliament. Prior to their approval, details are provided to the members of the Government Parliamentary Committee on Defence and Foreign Affairs. There are three main defence spending and procurement principles that MINDEF follows. Firstly, all procurements seek the most cost-effective solution. MINDEF’s preference is “to upgrade existing platforms to extend their lifespan and enhance their fighting capabilities instead of purchasing new ones unless the new equipment provides clearly superior and needed capabilities” (MINDEF, 2021h). Additionally, if there is a reasonable benefit, MINDEF works with local DI to develop its own solutions like the Terrex Infantry Carrier Vehicle. This approach is dominant, as mentioned by Philip Yeo (2016) “Singapore’s strength lies in logistics and technology. A lot of things we bought we would customise for ourselves.” Secondly, MINDEF is continuously reviewing its own and SAF operations and processes to identify areas for cost savings. The system encourages servicemen to seek greater productivity through various programmes. And lastly, MINDEF is focusing on a long-term view of defence needs and force planning. Parliament also appoints a Public Accounts Committee to work closely with the Auditor-General’s Office to conduct regular scrutiny of the MINDEF defence budget (MINDEF, 2021h).

In most cases, Singapore requires technology transfers and, at the same time, encourages foreign direct investment in the indigenous DI. As a result, foreign arms manufacturers targeting the Singapore market must transfer technologies. Singapore widely uses a lease-to-own arrangement as it aims to reduce initial investment, and, concurrently, obtain early access to advanced defence equipment and technologies (ICD Research, 2021).

The DSTA is responsible for the entire defence procurement process such as contract preparations, pricing, evaluation of risks, identification of contractors, evaluation of tenders, and, lastly, contract award. It is important to note that DSTA implements the most advanced managerial processes to prepare for future tendencies (Manohara, 1998). All the participants involved in the acquisition process are segregated into multiple groups to avoid corruption: approval of requirements, purchase, and verification of purchase. Major defence item acquisitions are evaluated using the Analytic Hierarchy Process, which involves scoring and technical assessment of performance, capability, growth potential, programme risks, and local industry involvement. All costs are weighed against benefits to determine the proposal that offers the best benefits and value to MINDEF, SAF, and Singapore’s budget.

In most cases, all tenders are open, but some of them could be selective due to secrecy, as sensitive equipment and services are procured (Manohara, 1998). Tenders can be evaluated in two ways- by the lowest offer for tenders below 7.4 million USD if they match requirements set in specifications; and secondly, by the quantitative selection methodology if tenders are complex, such as major defence items or systems and exceed 7.4 million USD. Negotiations could be possible too but that is an exception in most cases (Manohara, 1998; MINDEF, 2021i).

In order to ensure the best results in the procurement process, MINDEF follows three principles. Firstly, MINDEF is obliged to ensure an open and transparent tendering and approval process. All potential suppliers must be registered as government suppliers, which indicates the suppliers’ capacity to undertake government contracts. An award notice with the name of the supplier awarded the contract, as well as the contract sum awarded, is published on GeBIZ. Secondly, the procurement contract awarded is governed by the private law of obligations. And lastly, there are multiple measures in place to prevent corruption and procurement malpractices. In this regard, companies are discouraged from anti-competitive conduct, whistleblowing is actively promoted, and companies must follow a code of ethics issued by MINDEF. There are severe punishments for procurement officers involved in corruption. It is foreseen that periodic rotation, regular security vetting of procurement officers, and independent audits carried out by internal and external agencies would reduce the level of corruption (MINDEF, 2021i). Fighting corruption practices within MINDEF, SAF structures, and dealing with DI remain priorities (Yeo, 2016).

In most cases, MINDEF prefers fixed-price contracts, which might not always be suitable. The indications show that suppliers attempt to bid with a minimal price that, in return, might entail poor quality items or a service provided that is difficult to assess. However, considering long-term contracts with high risks, like R&D projects, a fixed-price contract is not suitable, as there are multiple factors affecting the final price. In this case, a cost-plus contract would be more relevant. External support like an audit by an independent private auditor could be a measure to minimise risks in calculating expenses if cost-plus type contracting is undertaken (Manohara, 1998).

To sum up, DSTA acts as the main hub of all SAF procurements. There are constant discussions on the correct approach for choosing a proper procurement strategy; nevertheless, the process seems well structured overall and aligned with Singapore’s MINDEF. Established procedures ensure scrutiny of acquisitions by greater civilian control layers and the absence of corruption. The main principle established for defence spending and procurement seeks a cost-effective solution that, in most cases, is directed toward local R&D and manufacturing.

Offsets

Offsets are seen as critical while also enabling local arms production. Brauer and Dunne (2011) identified that Singapore targets a certain arms niche that it desires to learn and master; therefore, the country structures arms import acquisitions and offsets demands towards the fulfilment of this goal. Interestingly, Singapore has “no formal offsets policy but channels most contracts through a special corporation set up.”

Richard Bitzinger highlights that Singapore offers an interesting role model for other aspiring arms manufacturers. However, he notes that offsets are not sufficient for a country that is trying to move up the production ladder as DI requires significant investment in equipment and in manpower. Bitzinger concludes that offsets will not make any great shortcuts in economical or technological domains. The scholar is confident that offsets cannot replace strong science and a technological base (Bitzinger, 2004).

Matthews and Koh (2019) note that defence offsets assisted Singapore DI in the “infusion of advanced technologies and learning,” highlighting that only one factor – Singapore’s defence export performance – is disappointing but insisting that this would improve in the future.

There are different perspectives in terms of assessing the efficiency of offset in the Singapore case. It is important to note that Singapore has no official offset policy, and therefore no data is available. Scholars espouse that the implementation of offsets contributed to the gradual development of indigenous DI as it was aligned with procurements; however, the proof is not yet visible as arms exports remain low.

Imports and exports of armaments

In addition to local production, the SAF is also supplied by large quantities of imported armaments (Table 2).

Table 2

Summary of arms imports and exports over 2000–2020, in million USD (SIPRI, 2020e, 2020f) (more specific data in Annex A and B).

The overall balance of Singapore’s arms trade remains negative as exports remain minimal compared with imports. The main suppliers, in the last two decades were the US, France, Germany, Sweden, Spain and Israel (Annex A) which provided multiple defence items (Table 3).

Table 3

Major defence items imported to Singapore in 2000–2020 (SIPRI, 2020d).

Most of the imported defence items are used to arm the SAF; however, some of the items are used to manufacture locally made major defence items such as Terrex APC, A330 AC, and LaFayette frigate. Locally made arms are also used in the SAF or simply exported.

Singapore is trying to increase arms exports (Annex B) by approaching two export strategies. Firstly, Singapore exports already used legacy armaments such as AC, AC trainers, helicopters, and mortars. In addition, some of the exported items are modernised to suit customer’s needs. Secondly, Singapore manufactures and exports brand new and novel major defence items including various types of ships and sea vessels, APC Bronco and 120mm Super Rapid Advanced Mortar System (Table 4).

Table 4

Singapore arms exports in 2000–2020 (SIPRI, 2020d).

Exports of armaments made in Singapore are focused on multiple countries in different regions. The largest export countries remain Thailand and Oman. Further, the intensity of export differs as there were times when no exports occurred, such as in 2005–2008 and in 2017–2020. Besides locally manufactured items, Singapore exports second-hand major defence items with or without modernisation. In some cases, barter deals are arranged, as in the case of an F-16A transfer to Thailand where Singapore was granted access to Thai training areas for 15 years.

Regardless of close bilateral cooperation, exports of defence items to the US market will remain a challenge for Singapore DI. Companies find it difficult to penetrate the US market. Examples show that sales to the US military are possible via partnering with US DI companies or primes. In that regard, Singapore DI could supply niche technologies or products (Bitzinger, 2008).

Looking at bilateral arrangements, the US-Singapore Free Trade Agreement resulted in a US export increase to Singapore valued at 5.1 billion USD by 2006, not including aircraft and spacecraft sales valued at 1.2 billion USD in the same period. In return, Singapore emerged as a major biosciences hub in the region, including investments from Microsoft. In addition, the Singapore-US defence cooperation agreement signed in 2015 states that the two countries seek to foster cooperation in biosecurity and technology. It is important to note that European defence companies are reaching out to the Asia-Pacific region in an attempt to facilitate sales (Fiott, 2016).

On the one hand, the SAF continue to procure foreign armaments and equipment for building SAF defence capabilities, and on the other, the competencies of indigenous DI are improving. The main arms imports are from the US, France, Germany, Sweden, Spain and Israel. Most of the arms imported are used by the local Air Forces, as Singapore DI is not focused on the air domain at the moment. Being one of the major arms importers in the world, Singapore also exports locally manufactured arms on a global scale, but at modest and unstable levels. This could relate to the priority given to local orders. Currently, exports focus mainly on various ships, 120 mm mortar SRAMS, and APC Bronco. It is expected that some of the platforms like Hunter, Bionix II, and Terrex AV-81 that are still under development would facilitate arms exports in the nearest future. Regardless of the intent for closer cooperation in the defence field, the US market is not accessible to Singapore DI. In due course, European manufacturers, looking for opportunities in Singapore, might be willing to consider more beneficial cooperation with Singapore DI.

Singapore DI, and a niche production business strategy

DI is a key element of the overall industrialisation policy and a strategic component of the Singapore Total Defence Plan (Kausal and Markowski, 2000). The government also views DI as capable of achieving three requirements: to meet the needs of the SAF; to provide products and services of good quality and price; and to contribute to Singapore’s economy (Manohara, 1998). However, Bitzinger concludes that Singapore DI is focused, firstly, on guaranteeing the supply and maintenance of critical defence systems, and, secondly, on the development of capabilities needed to upgrade and modify imported weapons systems (Bitzinger, 2021). This is in line with Manohara’s findings that a decision was made not to produce domestically a full spectrum of weapons systems and, instead, emphasise a cost-effective solution for Singapore’s defence industries and focus “on the development, upgrading and the depot-level maintenance of weapons systems used by the SAF” (Manohara, 1998).

To illustrate the overall progress of Singapore DI, it is important to highlight the findings of Tim Huxley (2004), who applauded the substantial progress made towards establishing a system of systems, required to implement needed changes in the Revolution of Military Affairs at a relatively low cost. These developments include the development of advanced weapon systems, C4 and ISR capabilities, integrated logistic support, and maintenance. He is not alone in defining the agility of Singapore DI as Michael Raska (2021) pays tribute to the ability of Singapore DI in leveraging technologies such as an artificial intelligence system. He notes that Singapore seeks to develop niche 4th industrial revolution technologies to advance their defence capabilities and competitiveness (e.g. data analytics for servicing fighter jets, autonomous underwater vehicles, and unmanned watchtowers). Raska states that advances are made through “strategic collaborations with leading research entities on global DI, as well as local small and medium enterprises,” interaction among the SAF, commercial, and science entities that is seen as key.

Based on the current members’ list of the Defence Industries Association, there are more than 60 local DI companies besides the ones originally belonging to ST Engineering. Nevertheless, SMEs that are involved in arms manufacturing are mostly subcontracted by ST Engineering (Bitzinger, 2021). Various industry associations, e.g. the Association of Aerospace Industries in Singapore, unite companies from particular sectors including those belonging to DI. Starting from 2019, there were attempts to unite the remaining companies working in DI but as of today, no visible progress has been made. In 2020, one of the associations, the Defence Industries Association, united only 13 DI and dual-use companies and a few individual members (DIA, 2021).

ST Engineering, with its headquarters in Singapore, is an engineering group specialising in the aerospace, electronics, land systems, and marine sectors. ST Engineering ranks among the largest companies in Asia and is listed on the Singapore Exchange. Its revenue for 2020 was USD 5.29 billion, and profits were USD 414.8 million. ST Engineering has over 100 subsidiaries and associated companies with nearly 23,000 employees in 24 countries (ST Engineering, 2021a). The majority of its shares – 51.54 percent are owned by Temasek Holdings, a Singaporean holding company, owned by the government of Singapore, with the remaining held by major institutions, funds, and investors worldwide. Additionally, Temasek Holdings constantly provides funds for various initiatives like the most recent – forming a joint venture for freighter aircraft leasing with 592.6 million USD value over 5 years (ST Engineering, 2021b).

Initially, Singapore DI was created to be self-sufficient through reverse-engineering and that remains a key strategy to this day (Yeo, 2016). ST Engineering was established in 1967 with the state-owned company Chartered Industries to manufacture ammunition for the SAF. In 1968, Singapore Shipbuilding and Engineering was established to build vessels for the Singapore Navy. Following that undertaking, more and more government-owned companies appeared in the DI sphere: Singapore Electronic and Engineering Limited established in 1969; Singapore Automotive Engineering in 1971; Ordnance Development and Engineering and Allied Ordnance Company in 1973; Singapore Aerospace Maintenance Company in 1975; Singapore Aero-Engine Overhaul in 1977; Unicorn International in 1978. Later, to better coordinate businesses and activities, all these companies were grouped into a holding company named Sheng-Li. Following reforms, from 1981 to 1990, DI companies were forced to commercialise to maintain their economic viability. Chua Beng Huat (2016) notes that from 1987, the government policy to force local DI to commercialise and expand their services to “non-defence related industries to maintain their economic viability and sustainability” was beneficial from a long-term perspective. Most of the companies became commercial enterprises through public stock offerings, with Sheng-Li retaining 51% of the shares. In 1990, another optimisation occurred as DI companies and Sheng-Li were regrouped, renamed, and rebranded as ST Holdings. It is important to note that ST Holdings avoided the “crowding-out” effect, similar to other DI companies, as it was not connected with western markets where defence budgets were dramatically reduced following the end of the Cold War (Manohara, 1998). The final restructuring was the transfer of ST Holdings to Temasek Holdings, owned by the government of Singapore, and to Singapore Sovereign Wealth Fund (Huat, 2016). It is no surprise that restructuring and optimisation is a constant activity as ST Engineering is a global company in a very competitive global market. The latest goal is to reorganise the inner ST Engineering sector-oriented structure of aerospace, electronics, land systems, and marine into two clusters: commercial and defence & public security.

Andrew Tan concludes that the Singapore DI has been relatively successful in achieving a measure of basic defence self-reliance, which at the same time “sends a deterrent message to would-be aggressors.” The author mentions key factors that helped to sustain DI growth: high defence spending; long-term strategic planning; an integrated defence ecosystem; technical expertise; dual-use competencies that lead to successes in non-defence related markets. Additionally, Tan notes that “the ability to refurbish old equipment, improvise and adapt weapons systems from a variety of sources for use, and maintain weapons systems and platforms for operational use, provides strategic and military benefits” (Tan, 2013).

As Jue Wang investigates Singapore’s innovation and government intervention dependency, he notes that innovation activities in Singapore are largely dominated by big players. Wang’s research indicates that ST Engineering takes only 7th place when calculating approved patents. As a result, he argues that DI is not seen by the government as the main innovation facilitator. The electronics, information and communications technology sectors were the most supported areas. In the future, environmental, water technologies, and interactive and digital media will be the areas that would spur innovations (Wang, 2018).

Ron Matthews and Collin Koh introduce a Singapore related term “defence-industrial ecosystem” which is supported by “quadrilateral stakeholder relations between, firstly, policymakers and funders (government); secondly, developers, comprising the labyrinth of defence-related R&D organisations; thirdly, producers (defence industry); and, fourthly, the network of trading partners and collaborators, operating in a global environment.” Furthermore, the authors conclude that “defence industrialisation was spurred by strategic vulnerability” and the key to success lay in “promoting synergistic civil-military industrial and technological integration” (Matthews and Koh, 2019).

Bitzinger describes Singapore as a successful country in certain niche areas. Singapore managed to emphasise its place as a capable second-tier manufacturer and even successfully participated in an F-35c Joint Strike Fighter programme. To play a subordinate role in the global arms market for small countries such as Singapore makes sense as they can make considerable economic and technological gain. This allows them to reach maximum competitive advantage at lower costs and, at the same time, gain new technologies, investments and new markets. In this case, no autarky ambitions could be achieved (Bitzinger, 2004). Jurgen Brauer and J. Paul Dunne confirm Bitzinger’s findings that Singapore’s DI is thriving because of its niche production business strategy (Brauer and Dunne, 2011).

In addition, Bitzinger is more sceptical about the innovation level that Singapore DI may aspire to. He concluded that Singapore, if compared with Israel, faces a less existential threat, and, therefore, its military-technological innovation activities are borne out of desire rather than necessity. Furthermore, Bitzinger states that most of the Singaporean indigenous weapons systems do not approach state-of-the-art, and are “remarkably prosaic in terms of technology and function.” Based on Tai Ming Cheung’s (2018) proposed technique for illustrating the country’s DI level of competencies and proficiencies, Singapore’s DI could be described as most capable of incremental innovation (Bitzinger, 2021).

To sum up, Singapore DI is seen as critical for the country’s security and economic growth. The scale and specialisation of indigenous DI is well balanced with the current manufacturing capability, which is oriented, firstly, towards rearming and maintaining SAF and, secondly, to increasing exports of dual-use items. Singapore DI has managed to survive for more than 55 years and established itself on the global arms market, where specialisation is viewed as key to its strategy. However, indigenous DI brings a limited innovation capability if compared with other sectors or even Israel. This situation is influenced by the government’s recognition that there are other emerging fields that offer more opportunities (e.g. water technologies, interactive and digital media). Furthermore, Singapore as a country faces a less existential threat than Israel and, therefore, its DI innovation activities are more out of desire than necessity.

Conclusions

The strategic aims set by the Singapore government for indigenous DI are widely met while considering that the Singapore government is not seeking autarky in arms production. Firstly, Singapore DI is able to provide defence articles for the SAF, which is not significant. ST Engineering, as the biggest local company, supplies the Singapore Army with 30 percent and the Navy with 38 percent of the types of equipment required. Simultaneously, DI maintains indigenously manufactured or imported equipment used by the SAF through its entire life cycle. Secondly, provided products and services for the SAF are of good quality and price. Procurement is overseen by Singapore MINDEF as it uses various types of contracts, audits, and effective programmes that prevent corruption. Furthermore, there are indications that indigenously manufactured defence systems allow the SAF to prepare for third-generation warfare. And lastly, DI is able to contribute to Singapore’s economy, as it proposes some innovation, ensures jobs and slowly is increasing revenues from exports.

Singapore DI has matured through a long, dynamic, and adaptive process that was influenced by external and internal factors. Firstly, the Singapore MINDEF plays a major role, where it coordinates procurements, innovations, R&D, and manufacturing policies. Most MINDEF structural elements use modern management processes that ensure an agile and cooperation culture. Secondly, there is substantial defence spending and a well-aligned procurement and offset strategy, which allows for increasing the competitiveness of local companies while preparing for future tenders. Still, there are some doubts if an offset strategy is beneficial in the long term unless it contributes directly to the creation of a credible R&D foundation. Thirdly, a close interrelation among all actors working in DI and surrounding sectors allows synergistic civil-military industrial and technological integration to be achieved. Intensive military cooperation with the US and neighbouring countries is also a crucial factor. Further, established entry barriers for foreign companies targeting the Singapore market require technology transfers or direct investment in Singapore DI or the economy. Additionally, timely diversification of Singapore factories towards the production of dual-use products while ensuring their economic viability and sustainability was a key factor. Moreover, the constant adaptation of ST Engineering helps it to remain active within the supply chains of the global arms trade. Lastly, proper scale and DI companies having a niche production business strategy can be seen as a winning factor, noting that the opening of new markets or new opportunities could influence this setting.

As a result, small countries aiming to increase the R&D and production capabilities of their respective indigenous DI should consider relevant factors within this case study. Furthermore, case studies of other small countries such as Israel, Sweden, and Switzerland would be beneficial, as this could also provide good lessons learned in terms of proper DI strategies for a small country.