Introduction

Modern conflict is no longer limited to military means, and ensuring a nation’s security and defence should no longer be perceived as an exclusively military task. From a military point of view, a country’s defence capabilities are the result of the interaction between several determining factors: the nation’s military capabilities, the adversary’s military capabilities, the will of the two countries to fight, and the nation’s vulnerabilities. A country may be faced with a strong opponent, which has a weaker will to fight, and as long as its own vulnerabilities are identified and mitigated, it has a higher probability of winning the conflict, even if its own military capabilities are weaker. Conversely, a country with strong military capabilities may be considerably weakened by its own vulnerabilities, even in the face of a weaker foe. Mitigating a country’s vulnerabilities also means building resilience and considering the importance of the national economy in peacetime, crisis, and war. Building economic resilience is an important component of ensuring national defence through various perspectives. In times of peace, a strong economy supports the development and maintenance of the required military capabilities. In times of crisis and war, adversaries may use economic tools as weapons of coercion and war and, at the same time, the economy plays a crucial role in supporting the war effort in the event the country is directly involved in a conflict.

The main research objectives of this paper are to identify the main factors of influence in economic resilience, approached from the perspective of the concept of comprehensive defence through the development of a composite economic resilience index outlining the relative economic resilience from a comprehensive defence point of view (Ericda) of countries in Central and Eastern Europe (CEE) and the Black Sea region and to propose policy recommendations for increasing the economic resilience of these countries within the concept of comprehensive defence.

The hypothesis of this study posits that the construction of economic resilience is a crucial component of ensuring a country’s resilience in an uncertain and volatile global context. This process demands a wider and integrative approach, specifically through the lens of comprehensive defence. The literature predominantly focuses on the macroeconomic, governance, social, and developmental aspects of economic resilience while dedicating comparatively less attention to its implications in the realm of defence. However, the use of economic tools and other instruments of hybrid warfare in the current security environment and the profoundly destabilising effect they could have on a country’s stability and development make the study of economic resilience from an integrated, multi-domain, and multi-disciplinary manner a prerequisite for the identification and implementation of concrete measures to increase resilience. This study aims to fill this research gap by including in the analysis of economic resilience other factors of influence pertaining to the hybrid warfare tools (such as energy dependence, foreign trade vulnerabilities, and human capital), or factors with influence on multiple areas of resilience, such as the military component (expressed through the amount of resources devoted to building and maintaining military capabilities and ensuring a country’s self-reliance in terms of arms and ammunition production) or the logistics and infrastructure component (crucial for economic development and military operations).

The paper employs qualitative research methods, focusing on the analysis of specialist literature pertaining to economic resilience. Quantitative methods are also used for developing the Ericda index perspective. This includes using data on selected resilience indicators in CEE and Black Sea region countries to generate rankings.

The results of the study demonstrate strong positive correlations between the economic resilience index, Ericda, and seven of the ten categories of factors analysed, confirming that economic resilience from a comprehensive approach should take into consideration additional categories of factors of influence in addition to macroeconomic and financial ones.

The concepts of economic resilience and -comprehensive defence—a literature analysis

Economic resilience, conceptualised as a nation’s ability to withstand and recover from economic shocks, disruptions, and crises, plays a critical role in ensuring the national security and stability of a country. This concept has become more prominent over the past decade, driven by numerous crises at both global and regional levels, in an increasingly multi-polar world. These include natural disasters, financial and economic crises, migratory pressures, energy crises, escalating tensions among key international actors, such as the United States, Russia, and China, the COVID-19 pandemic, the recent conflict in Ukraine, and renewed tensions in the Middle East.

The concept of resilience is explored in scholarly literature from a variety of perspectives. This breadth allows for an expansive understanding of its multifaceted nature. However, this approach can sometimes lead to ambiguity in defining the concept, potentially resulting in general measures and policies with limited practical impact in bolstering a country’s resilience (Reid and Botterill, 2013s, pp. 31–40).

Different international organisations offer varied interpretations of resilience. North Atlantic Treaty Organization (NATO, 2013) defines it as “the individual and collective capacity to prepare for, resist, respond to and quickly recover from shocks and disruptions, and to ensure the continuity of the Alliance’s activities,” while the European Union (EU) considers resilience “the ability not only to withstand and cope with challenges but also to undergo transitions, in a sustainable, fair, and democratic manner,” outlining four interrelated dimensions—social and economic, geopolitical, green, and digital resilience (Manca et al., 2017). In today’s interconnected economies, any regional event (such as a conflict, economic crisis, or natural disaster) can have spillover effects at a global level, generating the need to develop resilience, in particular economic resilience, in order to ensure that a country can withstand the effects of exogenous shocks of various natures.

In academic discourse, a comprehensive perspective on economic resilience is provided by Pendall et al. (2009, pp. 71–84), who describe it as a multifaceted concept involving adaptation and change within an economic system in response to external shocks and factors. Other authors (Rose and Krausmann, 2013, pp. 73–83) introduce a two-dimensional framework for understanding economic resilience, based on responses to external influences, delineating between static economic resilience (a system’s ability to maintain its functions during a shock, with a primary emphasis on optimising resource utilisation during times of scarcity) and dynamic economic resilience (the efficient allocation of resources for repair and recovery following economic downturns).

Economic resilience is most often approached in the literature from the point of view of economic resilience in the event of economic shocks (Akberdina, 2023, pp. 75–84; Briguglio, 2016, pp. 1057–1078; Dhawan and Jeske, 2006, pp. 21–32; Hill et al., 2012, pp. 193–274; Simmie and Martin, 2010, pp. 27–43). Economic shocks are understood as accidental, unforeseen events, or stochastic processes that arise in the region’s (national) economy or outside its boundaries, caused by various situations, such as economic crises, military conflicts, migratory flows, natural disasters, technological advances, demographic changes, and others (Bruneckiene et al., 2018).

From the perspective of crisis and disaster management, economic resilience is approached from a macro-economic perspective as the ability of the economy to cope, recover, and reconstruct, and therefore to minimise aggregate consumption losses (Hallegatte, 2014), or from a combined microeconomic and macroeconomic perspective (Pinkwart et al., 2022, pp. 763–786).

Economic resilience can be considered in connection with ensuring the critical infrastructure protection and resilience, as the two concepts sometimes overlap and are the foundation of ensuring social cohesion and economic prosperity (Australian Government, 2015; Roshanaei, 2021, pp. 80–102).

Supply chain resilience is another key perspective with direct implications on economic resilience from the perspective of private companies and national economies alike, defined as variation in the distribution of possible supply chain outcomes, their likelihood, and their subjective values, comprising “any risks for the information, material and product flows from the original supplier to the delivery of the final product for the end user” (Jüttner et al., 2010). Supply chain vulnerability is considered, as the result of risk, as an exposure to serious disturbance arising from the risk inside or outside the supply chain (Briguglio et al., 2008; Christopher and Peck, 2004, pp. 1–14).

Economic resilience forms an integral part of the overarching concept of resilience and is vital in guaranteeing human security and sustainable development. It is perceived not as a final state but rather as an extensive and multifaceted process (Atkinson et al., 2022).

Several studies in the literature are dedicated to identifying factors influencing economic resilience and developing a holistic economic resilience index (presented in Table 1), but the majority of these studies concentrate on economic descriptors.

Table 1

Economic resilience indexes in the literature.

| Year | Economic resilience index | Authors | Indicators |

|---|---|---|---|

| 2009 | Economic resilience index | Briguglio et al., 2008 | Macroeconomic stability, microeconomic market efficiency, social development, and good governance |

| 2015 | County economic resilience index (CERI) | Kahsai et al., 2015 | Industrial diversity, entrepreneurial activity and business dynamics, human and social capital, scale and proximity, and infrastructure |

| 2015 | Resilience index | FM Global, 2015 | Economic, risk quality, and supply chain |

| 2018 | Regional resilience to economic shocks (Resindicis) | Bruneckiene et al., 2018 | Insight capacity, regional governance, knowledge and innovation, learning capacity, networking capacity, and regional infrastructure |

| 2023 | The economic resilience index (ERI) | Hafele et al., 2023 | Economic independence, education and skills, financial resilience, governance, production capacity, and social progress and cohesion |

Although some of the indexes in Table 1 do approach economic resilience from a broader perspective (including influence factors, such as infrastructure, innovation, learning capacity, supply chain, human and social capital, and governance), they do not offer a view on the defence and national security connections of economic resilience.

The concept of economic resilience is one of the pillars of the total defence/whole of nation defence approach, embraced by countries, such as Singapore, Sweden, and China. In this case, the main goal of economic resilience is to ensure swift recovery from crisis and challenges, in close connection with other pillars of total defence, such as social defence, military defence, and cyber defence. (Lallerstedt, 2021; Matthews and Bintang Timur, 2023, pp. 1–21).

Elements from the unconstrained warfare concept (Liang and Wang, 1999), in which military means are to be used together with trans-military means (such as diplomatic warfare, network warfare, intelligence warfare, psychological warfare, smuggling warfare, and drug warfare) and non-military means (financial warfare, trade warfare, resources warfare, economic aid warfare, regulatory warfare, sanction warfare, and media warfare) can be identified in the current security and defence environment, and are used by several other actors in addition to China, where the concept originated. The use of non-military means of the unconstrained warfare concept highlights the need to approach economic resilience from a broader perspective, starting at business, community, or regional level and integrated at national and systemic level, addressing the provision of vital services, goods, and resources, as well as market access, security of supply chains and trade routes, financial resources availability, macro-economic stability, civil security in its socio-economic aspects, and safeguarding critical infrastructure, all aimed at preserving essential economic functions in the event of a crisis.

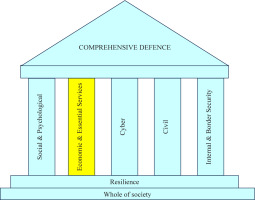

The evolving security and military landscape has highlighted the need for nations and international organisations, including NATO and the EU, to integrate economic considerations into the broader concept of national defence. The Allied Special Operations Forces (SOF) Command, NATO Special Operations School (2020, p. 15) views comprehensive defence as an official government strategy, which encompasses a whole-of-society approach to protecting the nation against potential threats based on six main pillars of defence—social and psychological defence, economic and essential services, military defence, cyber defence, civil defence, and internal and border security. All these pillars rely on the foundation of resilience, which should be the result of the efforts of the whole of society (Allied SOF Command, NATO Special Operations School, 2020, p. 17).

Despite the recent focus on economic resilience as a component of a comprehensive approach to defence, there is no study in the literature aimed at building a composite index of economic resilience from this perspective. This research gap constitutes the starting point and the rationale for this study, which intends to provide a framework for analysis of the complex relations between defence, the economy, and other essential areas of society, as they interact and build upon each other, in order to build trust, cohesion, and motivation within the entire society, as a prerequisite for resilience. Although the Ericda index focuses on ranking countries of the CEE and Black Sea regions (through the data selection), most of the indicators used are generic and applicable to any other region or countries, while just a few of the indicators selected are tailored to the current circumstances specific to the aforementioned region, especially considering the implications of the conflict in Ukraine (the dependence on foreign trade with Russia).

Methods

The starting point for providing a ranking of countries in the CEE and Black Sea regions in terms of the Ericda index are the six pillars outlined in the SOFCOM’s Comprehensive Defence Handbook (Allied SOF Command, NATO Special Operations School, 2020, p. 17) and complex interactions between them. The selection of both main categories of factors and indicators assigned to each category is based on the interactions between these pillars, as outlined in the following paragraphs.

The economic and essential services pillar starts from aspects pertaining to civil defence and mobilisation (such as providing essential services to the population; i.e., food, water, and medical support), but it goes beyond the classic concept of the preparation of the national economy for crisis and war and “encompasses building and sustaining a strong economy and durable critical infrastructure that can sustain the nation through economic challenges and national emergencies” (Allied SOF Command, NATO Special Operations School, 2020, p. 18). A weak economy cannot support the development of an effective military force, or it may not be able to support an appropriate education system, making the population vulnerable to manipulation. Poor infrastructure and logistics capacities can negatively affect economic development, and also hinder troop mobility in the event of conflict. Undiversified supply chains can lead to severe shortages in critical medical supplies, industrial components, and ammunition, and high inflation and unemployment can erode public confidence in authorities and social cohesion, making the country vulnerable when there are crises or hostile actions.

Ensuring economic resilience should be the outcome of combined efforts from governments, the private sector, and individuals, as outlined by the SOFCOM’s Comprehensive Approach Handbook, which states that “the public sector only comprises 2% of the nation’s prevention and response capability… meaning that the majority of the population is contained in the two non-governmental categories, the private and civic sectors, sometimes referred to as ‘the 98%’” (Allied SOF Command, NATO Special Operations School, 2020, p. 15). At individual level, a private citizen can contribute to economic resilience through education, re-skilling, up-skilling, and lifelong learning, especially in areas, such as financial skills and digital skills, in order to develop and maintain mobility and adaptability in terms of employment and to be able to adapt to the changing needs of the economy and the challenges caused by crises or technological advances. These actions can also contribute to diminishing the individual’s vulnerability to propaganda and cyber attacks and a better and more effective management of his/her finances and assets in order to avoid making bad financial decisions and to be able to withstand economic uncertainty.

Governments play a crucial role in fostering economic resilience, as a healthy and strong economy underpins national security. However, achieving this aim presents complexities, as it requires a combination of diverse and sometimes conflicting objectives and measures. The range of macroeconomic and fiscal policies designed to promote sustainable growth, develop infrastructure, foster innovation, maintain a strong social safety net, and cultivate a well-regulated financial system are just the foundation for achieving economic resilience in face of crises and shocks. The next layer is represented by the need to establish strategies and contingency plans and implement measures aimed at safeguarding critical infrastructure, reducing economic vulnerabilities, and upholding essential economic services (encompassing energy, communication, transportation, vital manufacturing, commercial facilities, and financial services) in times of crisis. This process is fraught with difficulties and requires a careful trade-off between achieving short-term economic objectives and medium/long-term national security and resilience objectives. For example, encouraging foreign direct investments (FDIs) can generate several economic benefits, such as infusion of capital that can lead to job creation, technology transfers, export opportunities, improved infrastructure, and enhanced productivity, all these factors contributing to economic growth. On the other hand, indiscriminately encouraging FDIs could have a series of consequences that may adversely affect resilience. Among these, the overreliance on FDIs can make the economy susceptible to external shocks or economic warfare actions from potentially hostile countries (the potential use of China’s Road and Belt Initiative for exerting economic influence, economic warfare, or even for military purposes, is such an example). Other consequences with potentially negative impacts could be the vulnerability to capital flight that could destabilise the domestic economy and exacerbate financial volatility, the limited domestic value addition if FDI is predominantly in sectors focused on assembly or low value-added activities, and environmental concerns related to the need to relax environmental regulations in order to attract FDI or to resource extraction practices. The purchase of extensive arable land, for instance, by foreign investors is a significant risk to resilience in relation to food supplies, as is the control by foreign investors of critical infrastructure companies. The extent of the phenomena is hard to quantify, as many such deals are not featured in the official records. According to the data provided by the Land Matrix (2023) database, a land monitoring initiative of the international land coalition, the cumulative land area size under contract in Eastern Europe increased by eleven times in 2022, compared to 2000, with Ukraine, Romania, and Bulgaria as the main countries closing land deals. According to a study by the Transnational Institute, up to 10% of agricultural land in Romania is held by investors from outside the EU, with a further 20–30% controlled by investors from the EU (Kay et al., 2015). Europe appears to be more vulnerable to this phenomenon than the United States, where with the exception of the state of Maine (where 21% of agricultural land is held by foreign investors), the percentage of foreign-held land as a percentage of privately held agricultural land is 3.1% (Farm Service Agency, US Department of Agriculture, 2021).

Reliance on foreign investors might also limit policy options and decision-making autonomy, affecting the ability to respond effectively to national crises, and if social welfare and inclusivity are disregarded, the consequences could be an exacerbation of income inequalities and social tensions, undermining social resilience.

In building economic resilience, the government authorities have the responsibility of ensuring the effective cooperation and interoperability of agencies from various ministries, NGOs, and other actors, through measures such as ensuring the legal framework to allow sharing information or resources, mitigating and eliminating technical and procedural impediments (such as a lack of interoperable procedures and equipment or common databases). Finally, in order to ensure economic resilience, government authorities (in collaboration with private companies) should provide the public with the tools needed to participate in developing resilience (through education, life-long learning, re-skilling and up-skilling, an emphasis on financial and digital literacy, and a proper understanding of the potential risks and crises).

The paper focused on analysing data related to seventeen countries in the CEE and Black Sea regions, sharing a series of similarities: a common past as members of the former Warsaw Pact, which determined common challenges in terms of economic structure, development, and transition to the market economy, and membership of the EU (eleven countries) and NATO (fourteen countries). Although a very important actor in the Black Sea region, Turkey, was excluded from the analysed sample due to its different economic, historical, and social circumstances. Beyond the usual indicators used in the literature to develop an economic resilience index, such as macroeconomic stability, microeconomic market efficiency, economic openness, export concentration, dependence on strategic imports, good political governance, social and environmental conditions (Briguglio and Galea, 2003, pp. 1–15; Rose, 2017, pp. 29–39), additional indicator categories were considered, such as human capital, logistics and infrastructure, military, and innovation and IT. The development of the Ericda composite index is based on ten main categories of determinants, as shown in Table 2, based on the following assumptions derived from the findings in the literature, in addition to the considerations outlined above in relation to developing economic resilience as a support of the six pillars of comprehensive defence.

Table 2

The main categories of determinants and the variables selected for development of the Ericda index.

The category of economic complexity was selected based on the findings in the literature that support the hypothesis that it contributes to a country's economic resilience by promoting diversification, adaptability, innovation, and reducing dependence on a narrow range of industries or products (Balland et al., 2022; Hausmann, et al., 2021).

The foreign trade vulnerabilities and trade concentration category is considered relevant to economic resilience, considering that an overreliance on a limited number of trading partners is identified in the literature as a significant factor in making a country economically vulnerable and reducing its resilience (Briguglio and Galea, 2003; Briguglio et al., 2008, pp. 229–247), leaving a nation susceptible to economic downturns or geopolitical conflicts. Additionally, a lack of diversification in export commodities can render a country vulnerable to price fluctuations and market demand shifts, while tariffs and trade barriers imposed by or on trading partners can disrupt export–import dynamics, affecting a country’s economic stability, even if the sanctions are not directly aimed at the analysed country. Supply chain disruptions, whether due to natural disasters or global crises, can disrupt the availability of essential goods, affecting both domestic production and consumer confidence. Recent crises, such as the COVID-19 pandemic and the disruption of trade in the Black Sea region due to the conflict in Ukraine, proved to be a stark reminder of the dangers to economic stability and resilience derived from the factors discussed above.

From a comprehensive defence perspective, overreliance on imports of strategic goods is a major vulnerability for a country’s resilience, with implications that go beyond the economic considerations. For instance, a high proportion of food imports as a percentage of total imports can render a country vulnerable to global food price fluctuations, supply disruptions, generate food security concerns, and negatively affect civil resilience and social cohesion. A heavy reliance on fuel imports can make a country susceptible to energy price volatility, geopolitical tensions, and disruptions in energy supply, potentially undermining a country’s ability to sustain military operations. A large share of manufactured goods imports in total imports may indicate a limited domestic manufacturing base, making the country dependent on external production and susceptible to supply chain disruptions. Should this reliance on foreign suppliers extend to military equipment and infrastructure, it has the potential to compromise national defence capabilities in times of need. A significant portion of electronic goods imports (excluding parts and components) in total imports may reflect a reliance on foreign technology and electronics, exposing the country to technological and supply chain disruptions, cost fluctuations, and also generating military vulnerability, as it may affect the maintenance and repair of military equipment, disruption of communication systems, or intelligence-related concerns. A substantial share of iron and steel imports in total imports may signify an inadequate domestic production capacity, making the country susceptible to price fluctuations and supply interruptions in the global iron and steel markets, and potentially impacting military resilience by affecting the production and maintenance of armoured vehicles, weapons, and infrastructure necessary for defence.

The economic stability and development dimension has three subcategories: macroeconomic stability, financial stability, and sustainable economic development. The selected variables provide the foundation for economic resilience in general, as controlled inflation, low unemployment, stable exchange rates, high investor confidence, and appropriate fiscal policy contribute to providing a buffer against economic shocks (Briguglio et al., 2008, pp. 229–247). In addition to the usual macroeconomic stability indicators (fiscal deficit to gross domestic product [GDP] ratio, unemployment level, inflation rate, external debt-to-GDP ratio, government debt as a percentage of GDP), the EU membership status was also considered, based on the assumption that the EU status and the need to comply with the EU stability mechanisms increases a country’s economic stability. Financial vulnerability has the potential to amplify the adverse impacts of economic shocks or hostile economic actions and has been approached through the perspective of the efficiency and stability of financial and banking sectors, and also from the perspective of the financial stability of households.

Sustaining economic development is another component of this category, with the economic freedom index indicator selected due to its positive effect on economic growth (Brkić et al., 2020, p. 26), as a high score signifies a favourable business environment that can enhance a country’s resilience by attracting investment, fostering economic growth, and creating job opportunities. Remittances as a percentage of GDP can contribute to a nation’s development in the short term by providing a source of income and reducing poverty, but such a dependence on remittances is assumed to be detrimental to economic resilience in the long term, as it makes the economy and the society vulnerable to economic shocks, encourages economic migration, and negatively affects social cohesion and the education of younger generations. High economic inequality is assumed to undermine social cohesion and economic stability, reducing overall resilience. A significant shadow economy as a percentage of GDP may indicate informality and tax evasion, potentially limiting government resources and fiscal resilience, in combination with the indicator tax revenue as a percentage of GDP, which reflects a country’s fiscal capacity, influencing its ability to provide public services and respond to crises.

Economic openness is assumed, based on the findings in the literature (Briguglio et al., 2008, pp. 229–247), to increase a country’s vulnerability and reduce its resilience, as a high ratio of trade (exports and imports) to GDP can make the nation overly reliant on international markets, rendering it more susceptible to global economic fluctuations, trade disruptions, and external shocks. Although FDIs can make a positive contribution to a country’s economic development, from the point of view of resilience, a high FDI-to-GDP ratio is presumed to increase a country’s economic vulnerability, as it may lead to dependence on foreign investors, leaving it exposed to potential capital outflows, changes in investor sentiment, and external economic conditions that can negatively affect its economic stability and growth. Such investments could also be used by a potential adversary to advance its interests and have a potential detrimental effect on the military component of comprehensive defence.

Energy dependence is assumed in the study to pose risks to a nation’s economic, environmental, and overall resilience, as a heavy reliance on foreign energy sources, particularly fossil fuels, can make a nation vulnerable to global energy price fluctuations, supply disruptions, and geopolitical tensions in energy-producing regions (Lewney et al., 2017; Wang et al., 2020). Such vulnerabilities can lead to economic instability, increased energy costs, and challenges in maintaining essential services and industries. A lack of energy diversification can hinder a country’s ability to adapt to evolving energy technologies and environmental imperatives, potentially affecting its long-term economic competitiveness. From a military perspective, energy dependence can weaken a country’s resilience by impairing its ability to sustain military operations for the required duration, increasing the costs of military operations, and generating logistical challenges. A country overly dependent on specific energy sources could find its military infrastructure and operations susceptible to attacks or sabotage.

The effectiveness of logistics and transportation infrastructure is assumed to have a substantial bearing on a country’s economic resilience as it directly affects its capacity to facilitate the seamless flow of goods and services, manage disruptions, foster global trade integration, and uphold resilient supply chains—fundamental elements for economic stability and flexibility (Chu, 2011, pp. 87–102; Lean et al., 2014, pp. 96–104; Lun et al., 2016, pp. 1–17; Munim and Schramm, 2018, pp. 1–19). Furthermore, it exerts a profound influence on a country’s defence capabilities, with direct implications on troop deployment during operations, the efficiency of supply chains, and the overall logistical effectiveness (Dowd et al., 2023, pp. 1–9).

Innovation and the IT sector are considered to be a crucial factor of economic resilience, as they contribute to the diversification of economy and contribute to a country’s global competitiveness and adaptability (Freire and Maruichi, 2019). The IT sector is particularly important for a country’s resilience from an economic point of view (as it serves as a cornerstone for a nation’s ability to adapt, innovate, and withstand economic shocks and fosters diversification by underpinning numerous industries, reducing dependency on traditional industries), and also from a societal point of view (having a pivotal role in facilitating communication, enabling remote work, and driving digital transformation). The IT sector is a crucial part of the comprehensive defence framework, as the civilian expertise and innovation provide critical support in areas ranging from cyber security to intelligence-gathering and information analysis. The sector’s innovations enable the development of robust cyber defence mechanisms, safeguarding sensitive government systems and critical infrastructure from cyber threats and attacks. Additionally, civilian IT expertise enhances data collection and analysis, facilitating more informed decision-making for defence strategies and national security. The IT technological advances may also contribute to the creation of advanced communication systems that ensure seamless coordination among defence agencies during emergencies.

Human capital and social cohesion are considered important factors in a country’s economic resilience, as a well-educated workforce is more versatile, innovative, and adaptable, allowing a nation to navigate challenges, seize opportunities, and be less vulnerable to disinformation, propaganda, and cyber-attacks. In this sense, financial education and digital education are crucial for ensuring economic resilience while also contributing to other pillars of comprehensive defence, such as the civil, cyber, and military pillars. Financial education equips individuals with the knowledge and skills to make informed decisions about their personal finances, investments, and debt management, enabling them to face economic challenges, plan for the future, and mitigate financial risks. Digital literacy enables individuals to effectively utilise digital tools, platforms, and resources, positioning them to participate in digital economy, access online education and services, and adapt to a remote work environment. At the same time, it reduces the population’s vulnerability to cyber attacks, manipulation through social media and other tools of hybrid warfare. A well-educated population is more likely to engage in informed civic participation and hold governments accountable for their policies, encouraging better governance and reduced corruption (Pereira et al., 2020, pp. 769–804; Visser and Jacobs, 2020).

The effective governance category is considered in the study to be an important contributor to economic resilience, as well as to every other pillar of comprehensive defence, as it underlines the entire framework for the effective functioning of a nation. From an economic perspective, it fosters transparency, accountability, and the rule of law, creating an environment conducive to business investment, innovation, and economic stability. From the point of view of social, psychological, and civil resilience, it can provide the framework for policies that prioritise social progress, human capital development, and equitable distribution of resources, reducing societal disparities and fostering social cohesion (Acemoglu et al., 2003, pp. 49–123). By ensuring that institutions are well-functioning and responsive, good governance instils confidence in the population in relation to the authorities and their decisions, and among domestic and international stakeholders, contributing to the civil, internal security, and military pillars.

A final category of factors considered relevant to economic resilience is the military perspective, as a strong military presence can protect a nation’s borders and critical assets, supporting economic stability. The levels of defence expenditures and defence investments are considered relevant, as adequate defence funding is required for ensuring economic resilience. In this context, adequate refers to an appropriate balance between defence considerations and economic considerations; the level of defence expenditures indicate a country’s commitment to maintaining military capabilities, which can deter external threats and promote economic stability by reducing the likelihood of conflict, but at the same time an excessive level of defence expenditures can negatively impact economic resilience by redirecting resources from the areas of activity promoting sustainable growth (infrastructure, education, and health) (D’Agostino et al., 2017, pp. 429–436). A robust defence industry can contribute to economic resilience by generating revenue through defence exports, boosting the domestic manufacturing sector, and providing skilled employment opportunities, and can also contribute to the military pillar by reducing dependence on foreign suppliers of military equipment and ammunition. NATO membership was considered relevant in the context of economic resilience from a comprehensive defence perspective, as being part of NATO provides collective defence guarantees, and enhanced stability can attract foreign investment and promote economic growth while reducing the economic burden of maintaining a large military force independently. Relying on multiple defence suppliers reduces vulnerability to supply disruptions and enables competitive pricing, ensuring that a country can maintain military capabilities without overburdening its economy.

The Ericda index has been calculated based on the following methodology: (1) Identification of the quantitative factors considered relevant to provide a broad overview of the factors that contribute to economic resilience; (2) constructing a hierarchy tree through grouping the selected indicators into six main categories; (3) populating the framework with data and normalising the indicator values; (4) allocation of weight coefficients to indicators and groups of indicators; and (5) calculation of the index for each country selected, using an additive expression. The analysis covers the 2017–2022 time frame. The specific selection and weighting of indicators was based on the paper’s objective of comparing the countries in the CEE and Black Sea regions based on the Ericda index. In order to minimise subjectivity in the analysis, equal weight was assigned to all the variables within a particular category and for all the selected categories.

The Ericda index enables the ranking of the countries in the CEE and Black sea regions in terms of economic resilience within a regional hierarchical system. The identification of the causality relations, and of the factors that drive resilience in the analysed countries, would be complicated because of the specific circumstances of each country.

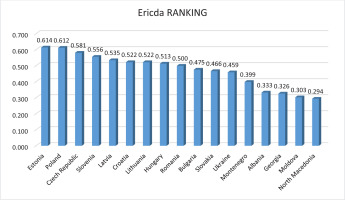

Results and discussion

The results in terms of ranking the selected countries based on the Ericda index are shown in Figure 2, from the highest ranking to the lowest ranking country. Estonia and Poland rank the highest, with a resilience index of over 0.6, while Albania, Georgia, the Republic of Moldova, and North Macedonia rank the lowest, with a resilience index of around 0.3.

Figure 1

Comprehensive defence pillars. (adapted from Allied SOF Command, NATO Special Operations School Comprehensive Defence Handbook 2020, p. 17).

Figure 2

The ranking of the selected countries based on the Ericda composite index.

Source: Author’s calculations of the Ericda Index.

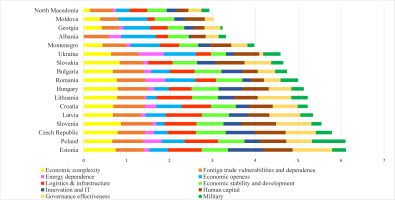

Figure 3 shows the contributions of each main category of factors to the overall economic resilience of each of the selected countries, reflecting the specific national situations. The results detailed for each category of factors are included in Annexure 1 (Table A1).

Figure 3

The main categories of variables contributing to the composite economic resilience Ericda index for each of the selected countries.

Source: Author’s calculations of the Ericda Index.

Pearson correlation coefficients were calculated between the Ericda index and the ten main categories of factors determining economic resilience identified, with the results presented in Table 3.

Table 3

Pearson correlation coefficients of factors determining the Ericda index of CEE and Black Sea countries. Source: Author’s calculations.

As per the results presented in Table 3, the Ericda index has a high positive correlation with logistics and infrastructure (0.844), economic complexity (0.821), foreign trade vulnerabilities and dependence (0.794), economic stability and development (0.778), governance effectiveness (0.760), military (0.728), and human capital (0.721). The results confirm that ensuring a country’s economic resilience from a comprehensive defence perspective should not be approached solely from the perspective of economic factors of influence (such as economic complexity, foreign trade vulnerabilities and dependence, and economic stability and development) but also taking into consideration the crucial importance of a robust logistical support system and transport infrastructure, effective governance, developing and maintaining appropriate military capabilities, and ensuring the proper development of human capital.

Although the Ericda index has a moderate correlation with innovation and IT (0.694), this capacity should not be completely excluded from the factors that could contribute to economic resilience from a comprehensive approach, as the findings in the literature show that European regions with strong levels of innovation registered higher levels of economic resilience (Bristow and Healy, 2018, pp. 265–284).

The Ericda index has a weak correlation with energy dependence (0.252), but this does not automatically imply that energy dependence has no bearing on economic resilience. It rather highlights the notion that energy resilience should be considered within the broader context of each particular nation, as a strong and stable economy is better equipped to withstand shocks and crises, even when it exhibits some degree of energy dependence. The availability of fossil fuel reserves, for example, is a positive factor for a country’s resilience in the long term, but in the short term, it will contribute to the resilience only if the country has the capacity to extract and utilise this resource efficiently, at a reasonable cost. Should the production cost be too high, it could negatively affect the country’s economic resilience in the short term. Different perspective on short-term resilience versus long-term resilience has to be defined by further analysis of the extent renewable energies could potentially replace the dependence on fossil fuel, especially on imports from unstable or hostile countries.

The Ericda index exhibits a negative correlation with economic openness (–0.353), confirming the findings in the literature that a high degree of participation in international trade can increase a country’s economic vulnerability (Briguglio et al., 2008, pp. 229–247), especially in the absence of actions taken by the government and private sector to develop other components of economic resilience and mitigate the negative effects of this vulnerability. However, this result should not be interpreted as an incentive for countries to engage in economic isolationism with the aim of building resilience, as a carefully thought and balanced approach to economic openness allows access to global markets and investments, reducing dependence on a single sector or domestic demand and encouraging technological innovation and knowledge exchange.

Based on the results of the study, four main groups of countries can be identified, where the average resilience index between the countries analysed is 0.471. Countries with an above-average Ericda score are considered to have a high (above 0.6) and moderately high resilience (between 0.5 and 0.6), while countries in the average range (between 0.4 and 0.5) are considered to have a moderate resilience, and countries with an Ericda score of under 0.4 are included in the lower resilience group, as outlined in Table 4.

Table 4

Groups of countries according to the Ericda composite index. Source: author’s calculations.

The limitations of the study were related to the limited data availability on specific indicators that could have been of interest for determining a more relevant index, such as the level of ammunition stockpiles. This is a crucial indicator of sustainability of military effort, with important implications for economic resilience if the national economy needs to be shifted towards a war economy in the event of conflict, but the data required by this indicator is usually highly classified.

In terms of data collection, the study has faced two main sets of limitation. One is the availability of indicators for the same year, for all countries. For example, the data taken from the World Bank databases refers to the year 2022 for logistics performance index quality of trade and transport-related infrastructure, to 2021 for export of high-tech goods, compared to overall exports, and to 2020 for government expenditure on education, but the author considered that the existence of data from the same year for all sample countries does not affect the results, considering that Ericda is a relative resilience index. In very few cases (such as for Gini index degree of inequality in the distribution of income/wealth), different years are used for the indicators due to the unavailability of data. Another limitation of the study is the complete lack of availability of data from specific countries (such as Moldova, Georgia, and Ukraine) for specific indicators, such as the adult participation rate in life-long learning, as these countries do not acknowledge the concept. In this case, the value used as proxy was approximated to the lowest value of the indicator from selected countries.

The Ericda index used a z-approach in the normalisation of data, so it measures the relative resilience of sample countries in relation to each other, not an absolute resilience index. Consequently, the index is not useful for determining the degree of resilience of a particular country, but could provide a useful starting point in developing common resilience-building strategies across the region, within the NATO or EU framework, as specifically tailored to the CEE and Black Sea regions and their members.

Consequently, further research based on more detailed data would allow the refinement and updating of results by including more quantitative and qualitative indicators in the study, especially regarding national security and defence (e.g. protection for companies producing strategic goods, such as ammunition, the degree of integration of policies with economic and resilience impact across government domains, dependence on FDIs for potentially hostile countries specific, to name but a few). A more thorough identification of the roles of government/business and individuals in generating resilience could be useful for providing the future area of interest in research.

One important conclusion that can be drawn from the study is that ensuring a country’s economic resilience from a comprehensive defence perspective is a very complex undertaking, which requires numerous trade-offs. One such trade-off refers to balancing short-term macroeconomic objectives with medium-term economic resilience, requiring careful consideration and adaptive policy-making to avoid sacrificing long-term stability for immediate gains. For example, household debt was found in the literature to stimulate consumption and GDP growth in the short term but to have negative long-term effects on consumption and economic growth (Lombardi et al., 2017).

Another trade-off identified refers to balancing the economic resilience considerations with the ones related to economic resilience from a defence perspective. All the selected indicators in the military category contribute to increased economic resilience from the comprehensive defence approach, as they refer to building strong defence capabilities and reducing dependence on foreign armament producers, but policies geared towards supporting the national defence industry may be in contradiction with the need to support other areas of the national economy. In this respect, economic resilience, especially from the point of view of comprehensive defence, should not be equated with economic growth. The high positive correlation between the Ericda index and the military category of factors outlines the importance of defence expenditures and a strong defence industry for economic resilience from a comprehensive defence perspective, but, at the same time, the findings in the literature highlight the fact that despite its potential beneficial effects, such as job generation, increased military spending leads to slower economic growth, and therefore negatively affects the resources available for defence in the long run, especially when increased defence spending is accompanied by a rise in public debt (D’Agostino et al., 2017, pp. 429–436; Rooney et al., 2021).

The results of the Ericda index study confirm the findings in the literature, especially the ERI index of the EU member countries (Hafele et al., 2023). Even though the ERI index is focused on economic resilience from a narrower sense and the Ericda index has a broader approach, the correlation between the two respective economic resilience indexes and some of the common factors considered (economic independence, human capital, financial resilience, and governance) is confirmed. The study also confirms the high resilience index ranking of Estonia and the moderate resilience index rankings of Slovenia, Czech Republic, Hungary, Lithuania, Latvia, and Croatia. From the point of view of the Ericda index, Poland ranks second, a significant difference compared to its twenty-second position out of twenty-five in the ERI ranking. From the point of view of economic resilience from the comprehensive defence perspective, Poland ranks highest in the military category, and above-average of the countries analysed in all the other categories, except foreign trade vulnerabilities, economic stability, and innovation and IT. Romania is ranked last in terms of resilience between the EU countries according to the ERI index, but according to the Ericda index, it is situated in the middle of the ranking. The result is mainly due to the second position Romania holds in terms of the military and energy independence categories, and the above-average rank in economic complexity. However, Romania ranks lower than average in foreign trade vulnerabilities, economic stability, logistics and infrastructure, human capital, and innovation and IT. Slovakia and Bulgaria are ranked in the middle-lower position of the Ericda index, while in the ERI ranking, they are at the twentieth and twenty-third positions, respectively, out of twenty-five countries analysed. Bulgaria ranks below the average of the countries selected for the Ericda index in three categories (energy independence, governance effectiveness, and military), while Slovakia ranks below the average of the countries selected for the Ericda index in three categories (foreign trade vulnerabilities, energy independence, and economic stability), registering a low score on the economic stability indicator. The lowest ranking countries in the Ericda index were not included in the ERI index, as they are not part of the EU.

The following recommendations are made following the results of the study, in order for the selected countries to address the future challenges related to ensuring economic resilience from a comprehensive defence perspective:

Fostering economic diversity through encouraging the growth of a diverse range of domestic industries and supply chains to reduce overreliance on a single sector or trading partner and implement policies that incentivise innovation and entrepreneurship to support growth of emerging sectors and take advantage of technological advances.

Maintaining a balanced approach to economic openness that promotes cooperation and growth while safeguarding national security interests, especially through a careful evaluation of foreign investments in critical sectors and infrastructure.

Prioritising domestic production capabilities for strategic goods, reducing dependence on imports, even if they are less efficient than foreign-produced goods. Investments in industries essential for national security and defence, such as those producing ammunition and dual-use technologies, should be considered as high priority.

Enhancing infrastructure and logistics capabilities through investments in robust infrastructure and efficient logistics networks in order to enhance internal operational efficiency but also to enable rapid mobilisation during crises and forces deployment, strengthening both economic and defence capabilities.

Improving financial sector resilience through the implementation of robust regulations and oversight to ensure stability of the financial and banking sectors, focusing on prudent fiscal policies, stress testing, capital adequacy, and liquidity management. Improve household financial stability by promoting financial literacy and risk-aware financial practices among households, encouraging savings, emergency funds, and responsible borrowing to enhance individual and collective financial resilience.

Maintaining macroeconomic stability through implementing sound fiscal and monetary policies to maintain controlled inflation, low unemployment, and stable exchange rates. Achieve a balance between short-term economic objectives and long-term resilience goals by avoiding the sacrifice of long-term stability for immediate gains and incorporating adaptive policy-making that considers both macroeconomic and resilience aspects.

Enhancing innovation and research through allocation of resources, coordinated policies and investments, particularly in the IT sector, collaboration with academia, private sector, and research institutions to generate new technologies and solutions that contribute to economic growth and adaptability but also in the area of dual use technologies. Invest in robust cyber security infrastructure to safeguard critical digital assets, networks, and data from cyber threats.

Enhancing human capital development by focusing on education and skills development, continuous learning and up-skilling programmes to enhance the population’s ability to adapt to evolving economic demands and technological advancements and by promoting society-wide efforts to improve financial and digital education to empower individuals to make informed decisions, participate in the digital economy, and increase resilience.

Implementing policies that reduce income inequality and promote social cohesion and address social disparities to ensure that all segments of society benefit from economic growth.

Emphasising strategic planning and collaboration not only between government agencies and other relevant domestic actors but also with neighbouring countries, regional organisations, and international partners to share resources and expertise; develop and regularly update comprehensive contingency plans that encompass various disruptive scenarios, which should involve various sectors, agencies, and stakeholders to ensure a coordinated response. Establish stockpiles of essential goods and resources, such as medical supplies and strategic materials, to mitigate supply chain disruptions during emergencies.

Continuously assessing potential vulnerabilities and risks through regular scenario analysis and risk assessments to identify potential vulnerabilities, anticipate challenges, develop strategies to address them and enable timely responses with the purpose of informing strategic decision-making and enhancing preparedness.

Conclusions

The countries in the CEE and Black Sea regions exhibit various levels of economic resilience from a comprehensive defence perspective. Poland and the Baltic states exhibit higher levels of economic resilience, while the selected countries from the Balkan and Black Sea regions (except Romania and Ukraine) show the lowest levels of resilience.

The results of the study highlight the fact that a very important area of interest in terms of economic resilience from a comprehensive defence perspective is the improvement of logistic and infrastructure capabilities. The current economic, security, and defence environment is characterised by increased competition for strategic resources, in the context in which the effects of climate change, supply chain disruptions, growing demand, or crises of various nature increase pressures on supply chains and potentially lead to resource shortages. From both economic and military point of view, countries should focus on adapting inventory management methods, invest in the exploration of alternative production sources, and increase their infrastructure investments in order to mitigate the economic effects of crises and enhance their defence capabilities at the same time. Investments in critical infrastructures should be a priority, such as upgrading transportation networks, energy systems, communication technologies, and other critical infrastructure.

Strengthening the effectiveness of governance is another important factor for resilience, from both economic point of view and other types of resilience. Implementing practices that prioritise transparency, accountability, and the rule of law to reduce corruption, enhance transparency, and ensure efficient policy implementation in all areas that compose a whole of society approach to defence.

The concluding recommendations, emerging from the research hypothesis and study findings, emphasise that isolated measures targeting individual pillars are insufficient in pursuit of effective comprehensive defence. Economic resilience extends beyond the sole responsibility of the finance ministry, necessitating the involvement of a broader array of actors. An integrated approach to comprehensive defence planning, transcending mere military dimensions, is advocated. This approach should encompass preparation, mobilisation, and contingency plans and procedures designed to uphold societal functionality in its entirety. These should be harmonised within a universally understood and agreed-upon framework, clearly delineating roles, responsibilities, and authorities. Parts of this framework exist in terms of institutions from the so-called “national security, defence and public order system,” but the framework needs to be extended beyond these current boundaries to include economic and financial aspects.